Cut taxes and regulations to strengthen Social Security and Medicare.

Key Highlights :

Americans have long understood that economic growth is essential for financial health. The 1980 election of Ronald Reagan was based on the belief that economic growth through tax cuts and deregulation was the best way to maximize the economy, defeat the Soviet Union, and rebuild civic pride.

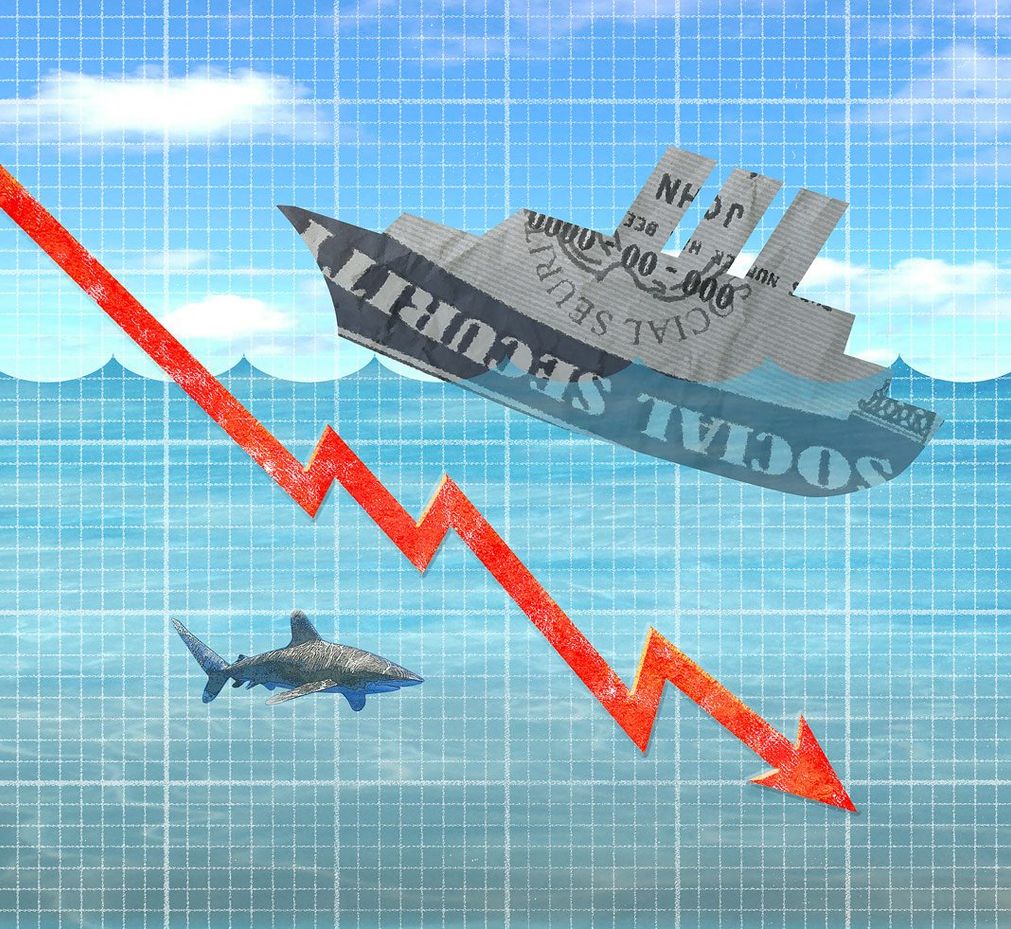

In a recent poll, Americans overwhelmingly agreed that economic growth is the best way to protect Social Security and Medicare from insolvency. This is because tax increases and burdensome regulations can hurt economic growth, which in turn weakens Social Security and Medicare.

Tax cuts and deregulation are key components of supply-side economics, which is based on the idea that reducing taxes and regulations will stimulate economic growth. Lower taxes and fewer regulations give businesses more capital to invest, which creates more jobs and higher wages. This leads to more spending, which boosts the economy and increases tax revenue.

The Reagan administration implemented supply-side economics in the early 1980s, and the results were impressive. The economy grew at a record pace, unemployment fell to its lowest level in decades, and inflation was kept in check. This economic growth allowed the government to invest in infrastructure, education, and other programs that benefited the nation.

The Reagan tax cuts and deregulation policies have been credited with helping to create the longest period of economic expansion in U.S. history. This period of growth has allowed the government to invest in Social Security and Medicare, which have kept millions of Americans out of poverty.

Today, the best way to ensure Social Security and Medicare remain solvent is to promote economic growth by lowering taxes and regulations. Supply-side economics has proven to be an effective way to stimulate the economy, create jobs, and increase wages. It has also been successful in reducing the national debt and increasing tax revenues.

In conclusion, Americans instinctively know that economic growth is the key to financial health. A recent poll showed that Americans support economic growth as the best way to protect Social Security and Medicare. Tax increases and burdensome regulations hurt economic growth and weaken Social Security and Medicare. The best way to ensure Social Security and Medicare remain solvent is to promote economic growth by lowering taxes and regulations, which has been proven to be an effective way to stimulate the economy, create jobs, and increase wages.

Continue Reading at Source : washingtontimes